FAQ

Frequently Asked Questions

What is Home Loan?

Home loan is the money borrowed from a bank or a housing finance institution on interest basis for buying / constructing / upgrading a residential property.

What is the Eligibility Criteria for a Home Loan?

Anyone — whether self-employed or salaried individuals/professionals — with a regular source of income can apply for home loans. Minimum age 18 years maximum 60 years

What is the tenure of a home loan?

Home loans are long term borrowing Instruments with a maximum tenure of 30 years and up to age of 70 years.

What is a Power Of Attorney?

A Power of Attorney is a legal document that Property owner grants someone the authority to act on behalf of him.

There are two types of power of attorney. First, the ‘General Power of Attorney’ where a property owner confers ‘general’ rights. The rights includes to sell, lease, sub-lease etc. The second one is the ‘Special Power of Attorney’ wherein only a specific right for particular property or transaction is given by the owner to the chosen person.

What is Pre-EMI?

The borrower is required to pay only the interest on the loan amount that will be disbursed as per the progress on the construction of the project. The actual EMI payment starts after the possession of the house.

How is the interest rate calculated?

The interest on home loans is usually calculated either on monthly reducing or daily reducing balance by Bank.

How do I benefit if the interest is calculated on a daily reducing balance

- Monthly reducing method :In this system, the interest calculated at end of the month, part payment can be paid in mid of the month that will be accounted in month end only.

- Daily Reducing method:In this system, the interest calculated on daily basis on principal outstanding. When principal amount decreases daily the interest calculated on the reduced balance results in lower interest payment.

What is a down payment/margin money?

Generally, banking & finance institutions pay around 75% to 90% of the property cost bought. The remaining 25% to 10% of the amount is paid on an up-front basis, which is popularly known as the down payment/margin money.

Can I sell the property even when the home loan is outstanding?

Yes, you can sell the property with the prior consent of the financing bank. If the buyer wants to take a loan to buy the property, the process is much easier if he/she approaches the same bank. In these cases, the bank does not need to release the property papers to another bank before getting the payment.

If the buyer wants to make a payment outright, he can make it to the bank directly. The property papers will be released only after the bank has recovered the entire loan amount and other dues.

What are the types of insurances available with Home Loan?

- Term Insurance product is offered by Life Insurance Company which offers financial coverage to the insured borrowers for full Home Loan tenor. In case of death of the insured individual during the policy term, the death benefit is paid by the company to the beneficiary Home loan account. This insurance is optional.

- Mandatory Property insurance that covers private residences and protects them from unpredictable damages and natural disasters.

Can I apply for a joint loan with my friend?

No. the application is signed by one or more members of your family such as Parents, Siblings and spouse.

Who can be joint borrowers in home loan?

Family members such as your parents, spouse and children are allowed to be joint borrowers in case of a home loan.

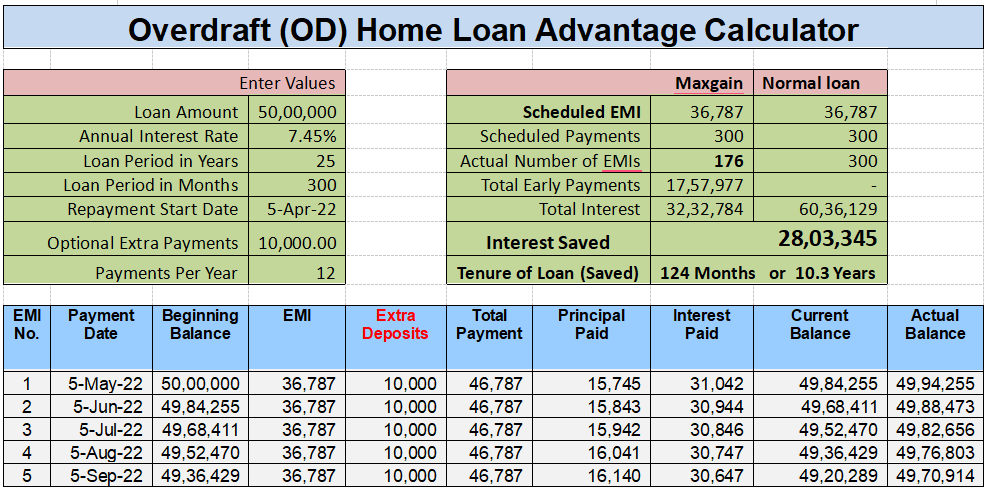

What is the Overdraft (OD) home loan?

Home Loans will be sanctioned as an Overdraft. While customers will have to remit the Equated Monthly Instalments (EMIs) as in the case of usual Home Loans, the Drawing Power on the Overdraft will be reduced on monthly basis to the extent of the principal component of the EMI so that the Overdraft is liquidated at the end of the loan tenure. (Interest component of the EMI remitted will service the interest obligations)

What is the maximum number of joint borrowers for a home loan?

The maximum number of joint borrowers in case of a home loan is fixed at six. However, only family members such as parents, siblings and spouse can be co-borrowers for a home loan in India.

What is floating rate home loan?

The base rates of banks are revised from time to time based on RBI directives as well as other factors, which leads to an increase or decrease in the EMI amount payable.

What is a fixed rate home loan?

Fixed rate home loans are offered by predetermined interest rate during the loan period and these remain unchanged during the loan period irrespective of market conditions.

Can I switch from a floating rate home loan to a fixed rate?

Yes. A few banks do offer you the option of switching from a floating rate to a fixed rate home loan. However, this is not applicable to all home loans and there are a few charges involved in implementing this conversion. In Fixed rate home loan Part and pre-payment is chargeable.

Should I apply for a home loan with a public or private bank?

We strongly recommended to Public sector banks, the PSU’s banks interest rate and charges are very nominal with transparency. Interest on daily basis, Part and pre-payment not chargeable.

What are the charges associated with a home loan process?

- Processing Fee– When applying for a Home loan, a fee is paid to the lender known as processing fee. The amount paid could be either a percentage of the loan amount or a fixed amount.

- Legal & Valuation Fee-Legal Charges for a home loan can vary depending on the banks. They can typically range from Rs.3000 to Rs.20000. Legal verification is an important part of a lenders due diligence before approving a loan. This helps protect the borrower and the lender from any future legal complications related to the property. The Valuation fees is charged to cover the cost of professional property valuation. The valuer assesses the market value of the property to determine the loan to value ratio. The valuation fee is typically between Rs.3000 to 30000, depending on the property value.

- Miscellaneous charges- Cersei fees, stamp fees are generally considered as miscellaneous charges by few lenders.

What documents do I need to submit with my home loan application?

Document submission may vary from one bank to other. The documents that need to be submitted as shown in Document page

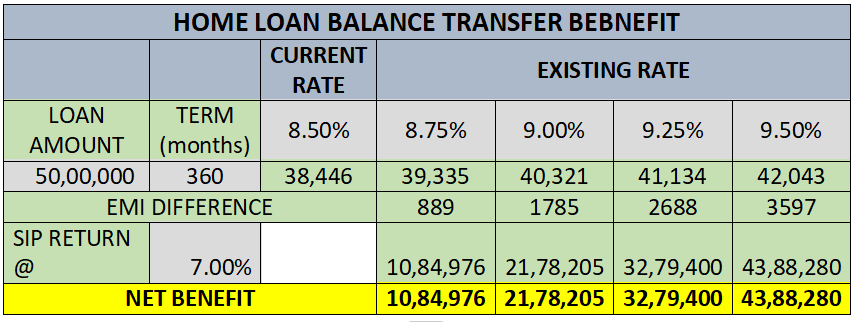

Is balance transfer of Home Loan with Home Top Up loan permitted?

Yes. Home Loan with Home Top up loan can be taken over subject to terms and conditions of balance transfer.

Is there any benefit to balance transfer?

Yes

Is there any tax benefit available on home loans?

Yes, the tax benefit on home loan in two sections

- Tax exemption on repayment of the home loan principal:This is the deduction allowed under Tax Section 80C with a maximum annual tax deduction of Rs, 150,000 under the section.

- Tax benefit on the interest on home loan:Under Section 24 of the Income Tax Act, you can avail the tax benefit on the amount of interest paid on a home loan to the maximum limit of Rs. 2 lakhs for a self-occupied property.

What is a top up loan?

If you have an existing home loan and have made timely repayments towards the existing home loan, you may get the option of borrowing an additional loan equal to the amount you have paid off on your current home loan. This is termed as a top up loan. The interest rates on a top up loan are less than a personal loan.

What costs are not covered in home loan?

Stamp duty cost and registration charges are not covered.

How do home loan requirements vary for an apartment and a plot of land?

When you take a home loan for an apartment, you technically apply for a home purchase loan. This type of loan is the most common one that is provided to individuals and is eligible for tax benefits under section 24 and section 80C. In case you want to purchase a plot of land for build your house in future, you have to apply for a land purchase loan and there is currently no tax exemption benefit for this type of loan. The loan tenure and interest rate may vary in plot purchase loan.

What is part/subsequent disbursement of a home loan?

Bank disburses loans for under construction properties in instalments based on the progress of construction. Every instalment disbursed is known as a ‘part’ or a ‘subsequent’ disbursement.

When does my home loan EMIs start?

EMI’s begins from the month subsequent to the month in which disbursement of the loan is done. For under-construction properties EMI usually begins after the complete home loan is disbursed, the customers can choose to begin their emi’s as soon as they have paid more principal in loan.

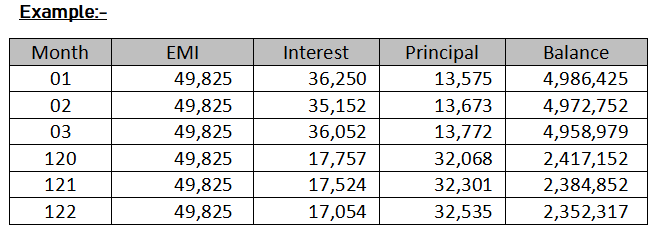

How does your home loan repayment work?

A home loan is usually repaid through Equated Monthly Instalments (EMI).The EMI comprises of the principal and interest components which are structured in a way that in the initial years of your loan, the interest component is much larger than the principal component, while towards the later half of the loan tenure, the principal component is much larger.

What is PMAY Scheme and how it can benefit Home Loan buyers?

The Pradhan Mantri Awas Yojana (PMAY) (URBAN)-Housing for All was a mission that was launched by the Government of India with the aim of boosting home ownership. The PMAY scheme caters to Economical Weaker Section (EWS)/Lower Income Group (LIG) and Middle Income Groups (MIG) of the society, given the projected growth of urbanization & the consequent housing demands in India. Credit Linked Subsidy Scheme (CLSS) under PMAY makes the home finance affordable as the subsidy provided on the interest component reduces the outflow of the customer on the home loan. The subsidy amount under the scheme largely depends on the category of income that a customer belongs to and the size of the property unit being financed.

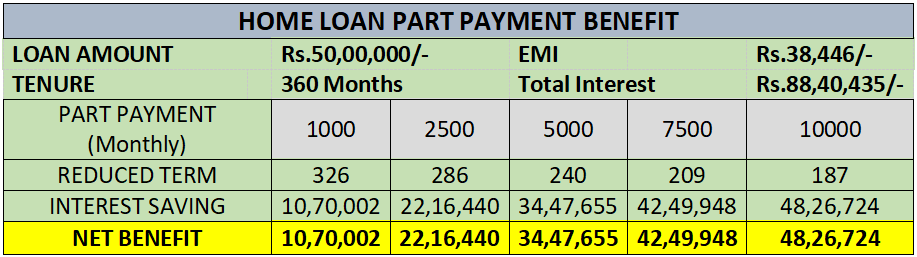

Can I prepay my outstanding housing loan amount?

Yes. You can prepay your home loan (part or full) payment before the completion of your actual loan tenure. Please note that there will be no prepayment charges on floating rate home loans.

What is a Loan against Property (LAP)?

Loan against property is a type of secured loan where you can borrow money by mortgaging your existing property as collateral. The LAP loan against fully constructed, freehold residential and commercial properties for Personal and Business Needs like marriage, medical expenses and child’s education etc.

Can I balance transfer the Loan against Property (LAP)?

Yes, Existing Loan against Property (LAP) from other banks and financial institutions can also be transferred – charges applicable.

What is maximum funding that I can avail on a property as LAP?

The Loan against Property being availed should not cumulatively exceed 60% of the Market Value of the mortgaged property

What is the maximum term for which I can avail a Loan against Property (LAP)?

You can avail a loan against property for a maximum term of 15 years or till your age of retirement, whichever is lower.

Can I avail Loan against Property (LAP) for a commercial property?

Yes, Loan against Property (LAP) can be availed against a fully constructed and freehold commercial properties.